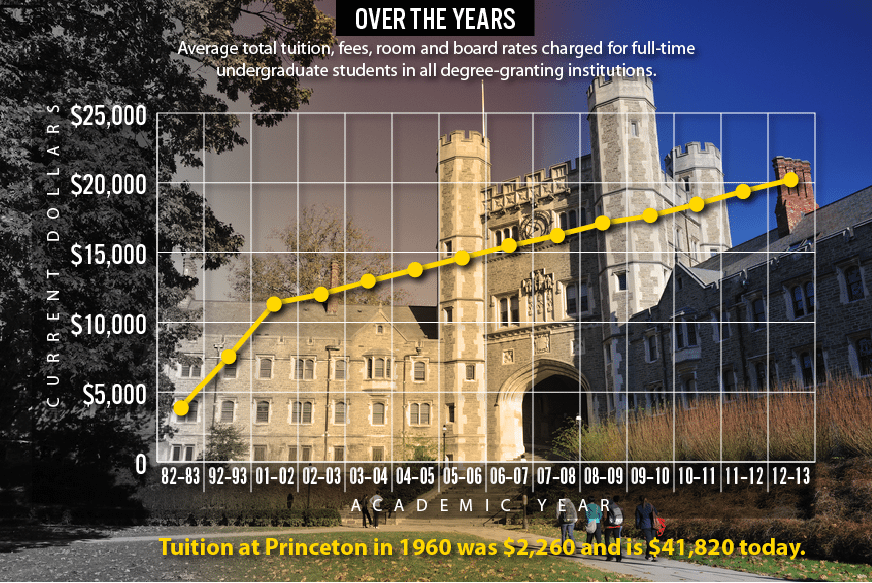

![]() With the exponentially rising cost of obtaining a higher education, more and more students are unable to achieve this goal purely with their out-of-pocket income. This means a larger portion of students are having to obtain student loans to supplement the amount of money they can allocate to attending a postsecondary school. These loans, although usually completely necessary, can cause a great deal of hardship for students who struggle to pay back their debt. This resource guide will walk you through the differences in different types of student loans and the steps you can towards and get student loan forgiveness.

With the exponentially rising cost of obtaining a higher education, more and more students are unable to achieve this goal purely with their out-of-pocket income. This means a larger portion of students are having to obtain student loans to supplement the amount of money they can allocate to attending a postsecondary school. These loans, although usually completely necessary, can cause a great deal of hardship for students who struggle to pay back their debt. This resource guide will walk you through the differences in different types of student loans and the steps you can towards and get student loan forgiveness.

![]()

Kenneth Williams is an author and higher education researcher. His work has been featured on many blogs and websites involving college reviews and guides for parents and college students. Born in Atlanta, Georgia, Kenneth spends much of his time researching how to assist students to achieve all their educational goals, while keeping their student debt to a minimum. He is a firm believer that education costs are entirely too high, and students should take advantage of what they can to not have crippling debt.

Kenneth Williams is an author and higher education researcher. His work has been featured on many blogs and websites involving college reviews and guides for parents and college students. Born in Atlanta, Georgia, Kenneth spends much of his time researching how to assist students to achieve all their educational goals, while keeping their student debt to a minimum. He is a firm believer that education costs are entirely too high, and students should take advantage of what they can to not have crippling debt.

![]()

![]()

A student loan is a completely different beast in comparison to student grants or student scholarships. A grant or scholarship is money awarded to students usually based on a merit system or a student’s needs, and they do not have to be paid back. A student loan, on the other hand, is usually given out on non-merit based situations and has to be repaid after a set time; this time is usually after the student would graduate from their school.

There are many different kinds of students loans that one might apply for:

● Stafford Loans (Direct Subsidized and Direct Unsubsidized);

● Perkins Loans;

● PLUS Loans;

● Health Profession Student Loans;

● Private Loans

There are many different benefits of obtaining a federal student loan over a private student loan, however, you might need to take out a small private loan based on your situation. We will go over this option later in the guide.

![]()

![]() Check Your Facts: Americans owe more in student loan debt than they do in credit card and auto loan debt combined.

Check Your Facts: Americans owe more in student loan debt than they do in credit card and auto loan debt combined.

![]()

![]()

As detailed in the previous section, there are a couple of different student loan options out there. In this section, we are going to give each loan a closer look as to what exactly they are, what benefits they offer, and what cons each might have.

![]()

![]()

![]()

The Stafford Loan is a loan offered by schools. These loans are offered to eligible students and have a low, fixed interest rate. What this means is for the entire life of the loan, the interest rate on it will never change. What your offered interest rate stays the same until it’s paid off. This can be very appealing for many students as the interest rate is almost always more favorable than the interest rate on many other student loans. However, because this loan is offered by schools, your school might not be a participant in this program and the school is the one that determines the maximum your loan can be, but your loan total still cannot exceed your financial need.

The Stafford Loan has two different kinds of loans offered:

![]()

![]()

The Direct Subsidized Stafford Loan is a loan with a fixed interest rate of 6.8% or lower, the federal government pays your interest for you while you’re in school and all you are responsible for is for paying the principal loan amount and any interest that accrues after you’ve completed school.

Due to all of this, Direct Subsidized Stafford Loans are a very favorable and popular option for many students. However, due to the popularity and favorable loan terms, a Direct Subsidized loan is a lot more stringent in who they will offer the loan to. The loan is only available to graduate and undergraduate students within a financial-need bracket, as determined by your school or university.

![]()

![]()

![]()

The Direct Unsubsidized Stafford Loan also has a fixed interest rate of 6.8% or lower, however, the federal government doesn’t pay the interest on this loan while you’re in school. Most students choose to defer their payments on this loan until they graduate, however, this means they are responsible for the principal loan, the interest that has already accrued, and all future interest accrual.

The Direct Unsubsidized loan has no need-based requirements and is available to any student that wishes to take out a loan through this program.

![]()

![]()

![]()

Perkins Loans are federal loans granted to graduate and undergraduate students with exceptional financial needs. These loans are always subsidized–meaning you won’t pay or accrue any interest for the duration of your time in school–and have a fixed interest rate of 5% after you graduate. These loans are generally repaid over a duration of ten years.

Perkins Loans are generally for higher amounts and have more favorable student loan forgiveness requirements, which we will touch on later.

![]()

![]()

![]()

PLUS Loans are offered to two different kinds of parties, parents of dependent undergraduate students and graduate students. These are known as Parent PLUS Loans and Student PLUS Loans respectively. A PLUS Loan is funded directly by the federal government, however, unlike traditional student loans, there is no maximum loan limit placed on these loans and they can be used to cover any costs not covered by other student aid. These loans have a fixed 7.1% interest rate.

For Stafford loans, Perkins loans, and PLUS loans, the applicant must fill out a Free Application for Federal Student Aid (FAFSA) form to see their eligibility.

Filling Out the FAFSA

![]()

What Happens Next?

![]()

![]()

![]()

Due to the high demand for people in the health professions and the higher than average debt these students will incur, there are loans available for specific areas of study in the health field.

There are four main loans available for those trying to enter this sector of study:

![]()

![]()

![]()

This loan is designated for certain health professionals that come from a disadvantaged background. This loan defines a disadvantaged background as any background that would inhibit a student’s ability to learn, and subsequently enroll, into medical studies. A disadvantaged background would also include financially-needy students whose family does not meet certain annual income criteria.

In order to be eligible for this loan, aside from being from a disadvantaged background, a student also has to be pursuing a degree in one of the following fields:

● Allopathic Medicine;

● Dentistry;

● Optometry;

● Osteopathic Medicine;

● Pharmacy;

● Podiatry;

● Veterinary Medicine

![]()

![]()

![]()

A Health Professions Student Loan is a long-term, low-interest rate loans offered to students seeking a degree in specific areas of health profession studies.

Students seeking a degree in the following areas are eligible:

● Dentistry;

● Optometry;

● Pharmacy;

● Podiatry;

● Veterinary Medicine

![]()

![]()

![]()

Primary Care Loans are loans offered to first- and second-year students at the standard loan amount which is capped at the cost of attendance and living costs. Third- and fourth-year students can obtain slightly higher loan amounts.

This loan type requires recipients to complete a residency program within four years of graduation, and requires you to practice primary care for ten years (including your residency time) or until the loan is repaid, whichever comes first.

The primary care fields this loan is eligible for are:

● Allopathic Medicine;

● Osteopathic Medicine

With some specialized fields also covered:

● Adolescent Medicine;

● Clinical Preventative Medicine;

● Geriatrics;

● Public Health;

● Sports Medicine

![]()

![]()

![]()

Loans through this program are available to undergraduate and graduate nursing students that are enrolled at least half-time. The grace period for these loans is nine months, which is shorter than with the rest of the health student loans. However, it’s consistent with the other loans in that this type of loan has a fixed interest rate of 5 percent after the grace period ends.

![]()

![]()

![]()

With private loans money is lent to borrowers by private institutions such as banks, credit unions, and state agencies. A private loan can allow a borrower to obtain higher loan amounts, but this loan path has more cons than the other kinds of loans available to students. Each private institution has its own rules and regulations on how and when the money is lent and how and when the debt must be paid back. These loans are never subsidized–meaning you will be responsible for the interest and principal even while you’re in school–and generally have a higher interest rate than the other listed loans. Private loans base the interest rate on your credit score, so having a lower credit score will mean owing more money back. And the interest rate on private loans is non-tax deductible. Another key con is that private institutions almost never offer loan forgiveness or income-based payment plans.

![]()

![]() Check Your Facts: According to a recent report by Barclays, 15.5% of outstanding student loan balances are held by Americans ages 50 to 59, and 4.2% are held by those 60 and older due to not having any access to debt forgiveness programs at the time of graduation.

Check Your Facts: According to a recent report by Barclays, 15.5% of outstanding student loan balances are held by Americans ages 50 to 59, and 4.2% are held by those 60 and older due to not having any access to debt forgiveness programs at the time of graduation.

![]()

![]()

![]()

Now that you understand what kinds of loans are available out there, we will take a look at what you can do if you’re unable to repay these loans back when the time comes. There are a couple of different options out there that will either get your loan forgiven completely or partially if possible. For loans that can only be forgiven for the partial debt amount–or can’t be forgiven at all–, we will take a look at some steps you can take to try and make your remaining debt more manageable. We will first give you some insight on what exactly student loan forgiveness is, and how you can utilize it to have a debt-free education.

![]()

![]() Check Your Facts: The price tag of an average student’s loan debt has risen to $37,172 in recent years. That’s a lot to expect students to repay.

Check Your Facts: The price tag of an average student’s loan debt has risen to $37,172 in recent years. That’s a lot to expect students to repay.

![]()

![]()

Student loan forgiveness is exactly what it sounds like. It’s terms set in a loan agreement that allows, under various circumstances, for your loan to be forgiven if you’re unable to pay it.

Most of the time a student loan can only be forgiven under extreme circumstances that are beyond your control. Some of the scenarios include:

● Your school closing;

● Your school defrauding you;

● Death discharge;

● Total and Permanent Disability Discharge (TPD Discharge)

Obviously many of these are not preferable means to get a discharge of a loan, however, there are some things that you can do to get student loan forgiveness.

![]()

![]()

![]()

Stafford Loans, both subsidized and unsubsidized, can be forgiven for those that are entering the education sector in an effort to encourage more people to become teachers. Under this program, if you teach full-time for five complete and consecutive academic years in certain eligible elementary and secondary schools or educational service agencies that serve low-income families, and you meet other qualifications, you may be eligible for forgiveness of up to a combined total of $17,500 on your subsidized or unsubsidized student loan. This loan forgiveness is called the Teacher Loan Forgiveness Program.

To apply for this loan forgiveness, you must print and fill out this form and mail it to the following address:

FedLoan Servicing

Attn: Loan Forgiveness

P.O. Box 69184

Harrisburg, PA 17106-9184

Fax: (717) 720-1628

If you need assistance with your application, you can call (800)-699-2908 to speak with a representative. Please note that the chief administrative officer of the school at which you performed your qualifying teaching service must complete the certification section.

![]()

![]()

![]()

You can get your Perkins Loan forgiven by performing certain types of public service, or by being employed in certain occupations. For each complete year of service, a percentage of the loan can be forgiven depending on the type of service provided. Depending on the type of loan you obtained, and when that loan was taken out, you may be eligible to cancel a portion of or your entire loan if you have served as one of the following:

● Volunteered in the Peace Corps or ACTION program (including VISTA);

● Are a teacher;

● Member of the U.S. armed forces (serving in hostile areas);

● Are a nurse or medical technician;

● Are law enforcement or corrections officer;

● Are a Head Start worker;

● A child or family services provider;

● Or you are a professional provider of early intervention services

There is no official form to complete for a Perkins Loan cancellation, you must contact the loan servicer that the school you attended has designated, or speak with the school the loan was provided by if they do not have a designated loan servicer. Your discharge application will be reviewed by the school and/or the school’s loan servicer. Until they reach a decision as to whether or not you qualify for loan forgiveness, you will still have to make payments on your loan.

This loan forgiveness program is called the Public Service Loan Forgiveness Program (PSLF).

![]()

![]()

![]()

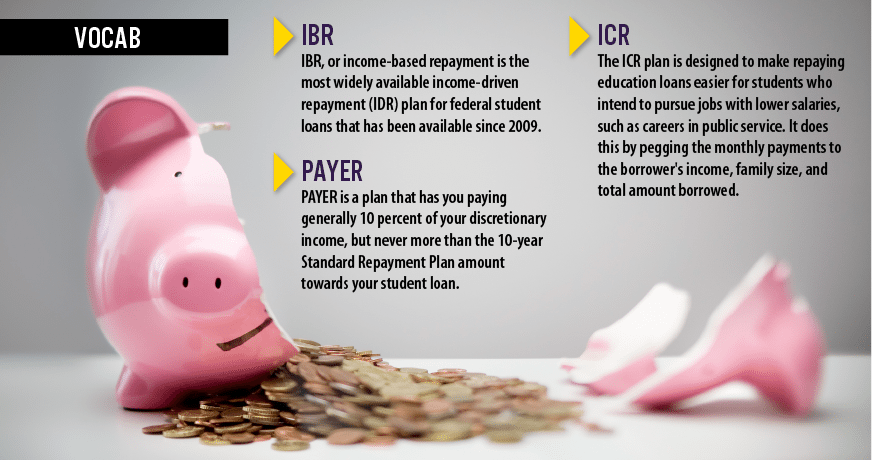

If you have a PLUS Loan along with a Stafford Loan, you are also eligible for the Teacher Loan Forgiveness Program with the same required qualifications and process. If you have only a PLUS loan or are not pursuing a career in the education sector, then you might be eligible for income-based repayment (IBR) and pay-as-you-earn repayment (PAYER) plans. You might also be eligible for income-contingent repayment (ICR), an earlier version of income-based repayment. These repayment plans base the monthly loan payment you owe on a percentage of discretionary income, as opposed to the total amount that you owe. These often yield a lower monthly payment than under other repayment plans, especially for borrowers whose total federal student loan debt exceeds their annual income.

![]()

![]()

![]()

![]()

Health Profession Loan recipients can receive up to $50,000 to repay their student loans in exchange for a two-year commitment at an approved NHSC site in what’s designated as a high-need, underserved area. The payment is free from Federal income tax and is granted at the beginning of your service so that you can quickly pay down your student loans. Approved sites are located all across the United States, in both urban and rural areas.

After completing your initial service commitment, you can choose to extend your service to receive additional loan repayment assistance.

The National Health Service Corps (NHSC) loan assistance program information can be found on this page.

Students in their final year of study may also be eligible for the Students to Service Loan Repayment Program. With this program, students may earn up to $120,000 in loan repayment assistance in exchange for working either 3 years full-time or 6 years part-time at an NHSC-approved site with a Health Professional Shortage Area (HPSA) score of 14 or higher.

Students can also inquire about a State Loan Repayment Program (SLRP), although not every state has a SLRP.

![]()

![]()

![]()

![]()

As stated earlier in this guide, virtually no private lender will forgive your loan debt. However, you can inquire with a representative at where you received your loan as to whether they offer any sort of loan forgiveness or lower repayment plans.

![]()

![]() Check Your Facts: Student loans are accruing nationally by more than $3,000 per SECOND. Imagine how much money student loans have accrued since you started reading this guide.

Check Your Facts: Student loans are accruing nationally by more than $3,000 per SECOND. Imagine how much money student loans have accrued since you started reading this guide.

![]()

![]()

If you’re not eligible for the preceding student loan forgiveness programs, or the student loan forgiveness program you received didn’t forgive all of your student loan debt then don’t fret as there’s still a couple of things that you can do:

![]()

![]()

![]()

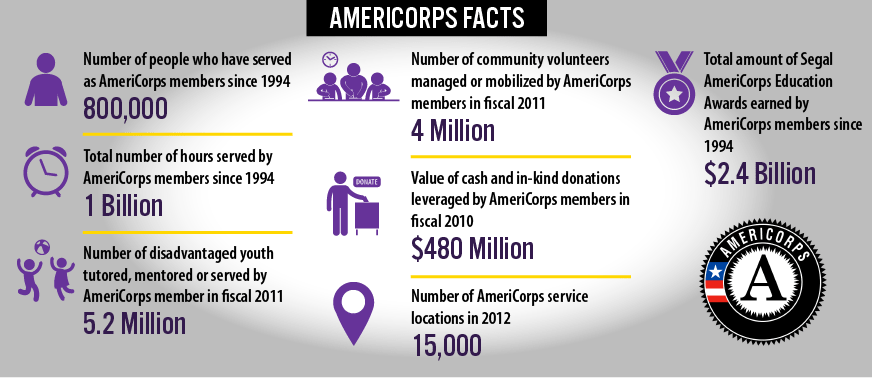

The following organizations offer one or more types of federal student loan forgiveness programs:

● Americorps;

● PeaceCorps;

● Volunteers In Service to America (VISTA)

Government employees in qualifying jobs can receive student loan repayment assistance. Whether or not a job is qualifying is completely at each agency’s discretion. To find out more about whether an agency qualifies, please see this FAQ on the Office of Personnel Management (OPM)’s site.

![]()

![]()

![]()

Military personnel receives student loan repayment assistance in exchange for their service. The College Loan Repayment Plan (LRP) is a benefit of committing to protect the country and has been utilized by much military personnel to get out of student debt.

![]()

![]()

![]()

A Work-Study Job Program is a program available to undergraduate, graduate, and professional students with financial needs. This is a paid program that encourages community service work or work related to one’s field.

![]()

![]()

![]()

If your degree is related to the field that you’re currently employed in, you can speak with your employer about getting loan repayment assistance. Not every employer offers this, nor is it guaranteed that you will be able to convince an employer that doesn’t participate in these programs to start–but if you approach this situation correctly, it won’t hurt to try.

If you can present to your employer how exactly your degree is benefiting the company and what you bring to the table, they will be more likely to want to invest in you, which could lead to student loan assistance.

![]()

![]()

![]()

One of the easiest ways of getting rid of student debt is to not accrue any to begin with. There are a lot of good resources out there that will help you learn how to make it through school debt-free or with a diminished debt. These guides can help you out a lot in the long run if you’re still currently in school and are planning on how to manage your student debt in the future.

![]()

![]() Check Your Facts: 42% of all students in America graduate without debt.

Check Your Facts: 42% of all students in America graduate without debt.

![]()

![]()

We hope this guide was helpful and informative for you on your road towards living a student debt-free life. The cost of education is so high which causes student debt to be very steep, so every little bit you can do to manage it will always be helpful. We understand dealing with debt can be hard and worrisome, but remember you’re not alone in this and there are numerous social media platforms you can use to reach out and talk with others that are managing their student debt for support.

For More Information:

● Stafford Loans

● Perkins Loans

● FAFSA

● Federal Student Aid

● Federal Student Aid Eligibility

● US Department of Education Loan FAQ

● Loan Servicer

● HRSA

● Americorps

● PeaceCorps

● Office of Personnel Management

Other Useful Links:

● Guide to a Debt-Free Education

● How and Why to Get an On-Campus Job

● Avoiding Loan Scams

● Guide to Identity Theft Protection