Frugal. Thrifty. Prudent. Economical.

Many people assign a negative connotation to these words equating them to being cheap, when in reality they should strive to try to incorporate the ideation behind these words into their everyday life.

Many people assign a negative connotation to these words equating them to being cheap, when in reality they should strive to try to incorporate the ideation behind these words into their everyday life.

Personal finance management is crucial, especially for students and their parents. Without proper personal finance management, students and their parents can quickly and easily be in for a world of financial hurt.

This is due to the fact that it’s practically impossible to obtain a college education without incurring some amount of debt, and this amount can be a hefty burden.

We have written this resource guide for college students and their parents in an effort to help them to properly budget their income, to avoid unnecessary debt whenever possible and to get out of any debt that may have already been incurred as soon as possible. Through the use of fiscal responsibility and intelligent finance management practices, students can avoid most long-term debt.

Zachary Heather is the financial manager for a successful startup based in Chesapeake, Virginia. He is 27 years old and managed to pay off all of his student debt within two years of graduation — a success which he attributes directly to the nature of his degree.

He spends his free time writing pieces like this one, and informative articles for money management sites because he believes that while some debt is a necessary evil, it can be managed effectively — and eliminated. He lives in Virginia so he can be close to his budding family and business, as well as the unrivaled Chesapeake Bay crab cakes.

Debt — from the Latin word Debitum, meaning “something owed” — is the state of owing something, usually money, to an individual or an entity. This is a financial obligation and burden that most people experience at some point in their lives. Taking on too much debt can easily lead to becoming over-leveraged and overextended in finances, which only leads to a hard-to-break cycle of constantly sinking deeper in debt or, at the best, barely treading the murky waters of debt while struggling to live paycheck to paycheck.

Debt — from the Latin word Debitum, meaning “something owed” — is the state of owing something, usually money, to an individual or an entity. This is a financial obligation and burden that most people experience at some point in their lives. Taking on too much debt can easily lead to becoming over-leveraged and overextended in finances, which only leads to a hard-to-break cycle of constantly sinking deeper in debt or, at the best, barely treading the murky waters of debt while struggling to live paycheck to paycheck.

The ramifications of being in debt are overwhelmingly negative. Because an individual is in debt, they will have to allot a decently-sized portion of their finances to pay on this debt on top of having to pay on their other financial obligations and necessary living expenses. This can easily lead to people having a hard time either paying on their debt or having a hard time paying their other financial obligations, which can very quickly lead to sinking further in debt.

Being overextended will also quickly destroy the credit score, making it next to impossible to take out favorable, low-interest loans on big ticket items, such as a house loan or a car loan. Because it will become so difficult to take out a reasonably low-interest loan when the need might arise, individuals that are in debt will have their hand forced to take higher interest loans, which will exacerbate the entire issue even further.

How many times have you heard a variation of these loan claims that constantly bombard unsuspecting people on television, the Internet, the radio, in printed publications and pretty much everywhere else? How truthful do you think these loan providers are being?

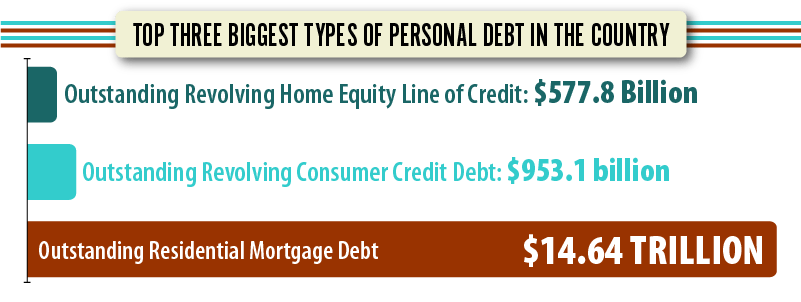

Debt is something that most people struggle with in this day and age. With the amount of easily accessible lines of credit and numerous types of loans offered by a myriad of private corporations, many people quickly find themselves drowning in debt without a clear understanding of how it even happened.

Debt can ensnare people so quickly and thoroughly and can be next to impossible to get out of for those that don’t understand exactly how to do so. Debt is structured in such a way that it purposely tries to keep debtors indebted. This is because loan providers will be able to collect more interest on a loan the longer it takes an individual to pay it off.

So you see, loan corporations do not want people to get out of debt quickly, because the longer they are paying on a loan, the more money the company will make off of it. This is purely due to two factors:

So you see, loan corporations do not want people to get out of debt quickly, because the longer they are paying on a loan, the more money the company will make off of it. This is purely due to two factors:

The first factor is a thing called the annual percentage rate (or APR), which is the amount of interest on the total loan amount that will be paid annually and is averaged over the full term of the loan, so a lower APR will translate to lower monthly payments. A higher interest rate (which is included in the APR) means more money will end up being paid back to the loan provider than what was originally borrowed. The higher the interest rate, the more money the loan provider will make and the longer it will take for the loan to be paid off, which will further increase their profits as well. The reason that the amount of time it takes to pay off a loan translates to more money being paid back is due to the fact that when someone pays the minimum monthly payments (which is what extends the life of the loan to the maximum), they are barely paying back anything more than just the interest rate on the loan and not on the principal of loan itself.

The second factor that plays into why lenders would want a borrower to take longer to pay off a loan is due to the borrower’s assets that are used as collateral on the loan. The longer it takes for the borrower to pay off a loan, the more likely it is that they will eventually default on the loan due to unforeseen circumstances. When a borrower defaults on the loan, the lender is legally able to seize these assets as a way to recoup their loss of the money on the defaulted loan, but usually these assets have a higher monetary worth than what the original loan was for. These assets are usually personal cars, houses and land.

An example to clarify what we have gone over:

Say you take out a car loan for $20,000 USD with an interest rate of 20%* and a loan term of five years and you take the full five years to pay the loan off.

Say you take out a car loan for $20,000 USD with an interest rate of 20%* and a loan term of five years and you take the full five years to pay the loan off.

Your monthly payments on this loan will be $529.88. However, over the life of the loan, you will end up paying a total of $31,792.66.

This is because $11,792.66 of your payments went solely towards the interest on the loan on top of the $20,000 principal you paid.

If you were to take out the same loan with the same interest rate and the same loan term, but you pay the loan off in 37 months (3 years and 1 month) instead of the 60 months (the five years) by paying an additional $530 a month (bringing your monthly cost up to $1,059.88), you will end up only paying a total of $24,213.66, which will save $7,579.00 in total.

*These numbers are purposely high to clearly highlight the amount of savings you could obtain by paying a loan off quicker and, as such, your savings on a loan will differ depending on the total loan amount, the loan APR, the loan life and your total available financial budget.

Surprisingly, maintaining a low-interest rate debt can have a few beneficial side-effects. Sure, it means you will have less money per month due to your debt-to-income ratio, but maintaining a low-interest debt by paying the minimum payments or a little over the minimum payments can help you to establish a credit score, gain a positive credit score or increase your credit score.

Surprisingly, maintaining a low-interest rate debt can have a few beneficial side-effects. Sure, it means you will have less money per month due to your debt-to-income ratio, but maintaining a low-interest debt by paying the minimum payments or a little over the minimum payments can help you to establish a credit score, gain a positive credit score or increase your credit score.

Paying on an established loan will prove to creditors — the people that utilize your credit score to determine how high of a risk you are to extend a loan to — that you are capable and responsible when it comes to paying on what you owe. Obviously you will not want to extend a high-interest rate loan for longer than you absolutely must, as this will be way more pricey than a low-interest rate loan in both the short-term and the long-term.

A secondary benefit of maintaining a low-interest debt rather than paying it off as soon as possible is it will allow you to save back money for any unforeseen events, such as car repairs or an emergency home repair. This is only recommended if you actually budget your finances and plan to save back the extra money that you will have from not paying more on your loan each month; if you have a hard time budgeting your finances and not touching saved money to purchase frivolous items or for entertainment, then the extra money would be better spent on paying down your debt.

Being in debt as a student might not seem like a huge deal to you, but it really is. You should avoid incurring debt whenever possible. Debt can hang over your head like a rain cloud and negatively impact your life in ways you might not even think about right now.

For instance, after graduation you will likely be looking to start your new career in a field that is related to the degree you have obtained. However, many employers run credit checks on their applicants in an effort to gauge whether or not a particular applicant is responsible and trustworthy. If you’re in debt and it has negatively impacted your credit score, which is likely, it will make getting a start on your career that much more difficult.

The only types of debts that won’t have such a negative impact on your credit score are low-interest loans, such as student loans that were not obtained from a third-party lender (a student loan obtained from the government as opposed to one from a private bank), car loans and house loans. These three loan types typically come coupled with lower interest rates than private loans do.

Racking up a large amount of debt or taking on debt with unfavorably high-interest rates can easily have a negative impact your finances, and the impact can last a life-time. We recommend avoiding making purchases with credit cards as much as possible, and only using a credit card when you already have the means to pay off the debt incurred. This is even more important for college students than it is for working professionals as you will likely have a smaller pool of funds with which to pay off your credit card debt in a timely manner.

Racking up a large amount of debt or taking on debt with unfavorably high-interest rates can easily have a negative impact your finances, and the impact can last a life-time. We recommend avoiding making purchases with credit cards as much as possible, and only using a credit card when you already have the means to pay off the debt incurred. This is even more important for college students than it is for working professionals as you will likely have a smaller pool of funds with which to pay off your credit card debt in a timely manner.

Furthermore, you’re already incurring at least some unavoidable debt due to attending college, so you should go out of your way to avoid incurring any unnecessary debt, particularly the kind of high-interest debt that comes with the use of credit cards. We understand that the allure of getting something that you want or need right now is very strong, but it’s simply just not worth it in the long run.

We also strongly recommend that you do everything possible to graduate from college with little to no student loan debt. There are many excellent resources available online that can help guide you through the steps necessary to achieve this. If you have already incurred student loan debt and would like to find out more information on how to obtain loan forgiveness that will forgive your student loans either in full or partially, we have resources available online for that as well.

On top of the advice from these resources, there’s many small steps that you can take to lower your education-related debt, and these small things will really add up over time:

Federal Student Loans

You can take out a government education loan as opposed to a private loan from a bank or another lender. These government loans are generally subsidized (meaning the government pays on the interest while you’re attending school, and you do not start making payments until a set time after you graduate) and are coupled with lower-than-average interests rates, making them highly desirable loans. These government loans are widely acknowledged as being the absolute best student loans you can obtain.

Scholarships

You can also apply to as many scholarships that you’re eligible for, as student scholarships do not have to be paid back at all — they are granted based on eligibility and need and are essentially an avenue you can utilize to decrease your education costs with no negative effects in the short-term or long-term.

Federal Student Aid and Internships

The Free Application for Federal Student Aid (commonly referred to as the FAFSA) should be each student’s first stop on the road to decreasing the amount of student debt they might incur, and the second stop should be the U.S. Department of Education’s page on scholarships and grants and their page that provides details on Work-Study programs.

Work Part-Time

On top of the various low-interest government student loans and student scholarships available, you can also look into getting an on-campus part-time job, a part-time job at a corporation or a paid internship. There are usually many on-campus jobs and paid internships available to students, and many of the on-campus paid internships (such as a laboratory assistant or teacher’s assistant for example) can provide you with real-world experience in your specific area of study that you can utilize after graduation to start your career in your chosen field a little easier and quicker.

Putting your child or children through college can be a very mentally taxing and scary prospect. We strongly encourage you to actively engage and participate with them during every stage of their transition to college life, from helping to pick out a school that will fit their needs and desires to helping them to do research into the various grants and scholarships that are available to them.

Putting your child or children through college can be a very mentally taxing and scary prospect. We strongly encourage you to actively engage and participate with them during every stage of their transition to college life, from helping to pick out a school that will fit their needs and desires to helping them to do research into the various grants and scholarships that are available to them.

This will not only provide them with an immense amount of emotional support during a time that is equally — if not more — mentally taxing and scary for them as well, but it will also give them a greater chance to have a successful college experience that won’t drown them in debt.

As for how debt relates to you as a parent of a soon-to-be college student or a current college student, you might decide to apply for a PLUS student loan to assist your child in paying for the cost of attending college. This student loan has a fixed and very favorably low-interest rate, which makes it an excellent choice if you’re eligible to receive it and if you do not mind incurring debt on your child’s behalf.

This is the only student loan we can in good conscience recommend parents to take out for a child’s education. Taking out private, unsecured loans in the large amounts needed to cover education costs is a sure-fire way to burden yourself with a debt that can easily overextend your financial budget, which is incredibly detrimental to not only your personal financial stability but it can also have a negative impact on your child or children during their time attending college, as they will not have a financial cushion to fall back on if something unforeseeable happens. It is also likely to cause students a great deal of distress knowing that a parent is in an unstable position on their behalf.

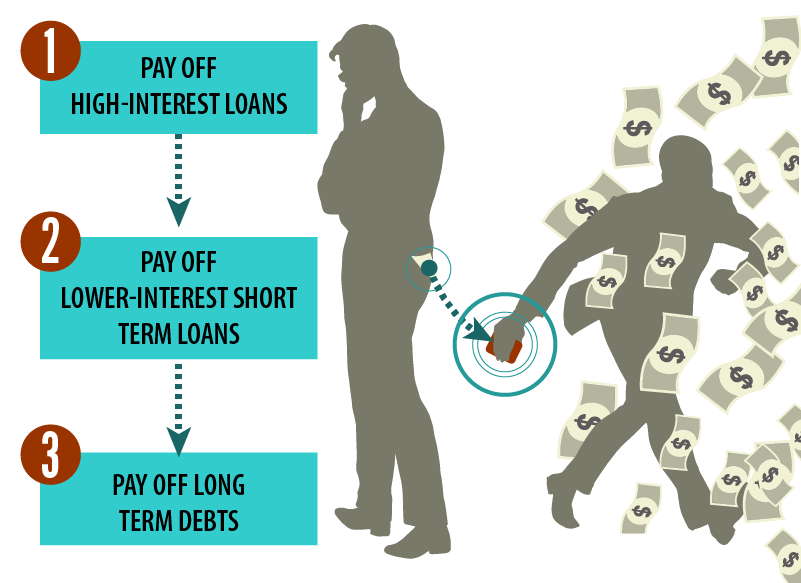

Knowing which debts to pay off first can be a very easy task if you know what to look for.

High-interest debt and debt that comes with unfavorable terms should be your first priority to pay off. This is because the longer you pay on these kinds of loans, the more you end up paying out. So the first forms of debt you should work on paying off would be secured private loans that are offered through places such as Payday Loan providers and Title Loan providers and unfavorably high-interest rate credit card debt.

The next forms of debt that you should work on paying off after you have paid off your high-interest loans would be any low-interest loans that have a very short term. Because these loans can be paid off quickly, you should go ahead and settle them down to a balance of zero, which will allow you to have a better debt-to-income ratio.

The final forms of debt you should work on paying off would be lower-interest long term debts, such as car loans and home loans. Many of these forms of long term debts can be refinanced after a period of time which can potentially lead to a lower overall principal and an even more favorable interest rate.

Credit cards can either be the worst thing that happens to your financial budget and credit score, or the best thing. Which one it is relies purely on how you utilize them.

With responsible, mindful and sparing usage, credit cards can help you to establish credit or even give your credit score a huge boost. The credit cards that we would recommend that you apply for and use would be prepaid credit cards. These credit cards are essentially reloadable debit cards that can positively affect your credit score. Because these cards are prepaid, there’s no fear of spending more money than what you have, which is a very real concern with standard credit cards.

With responsible, mindful and sparing usage, credit cards can help you to establish credit or even give your credit score a huge boost. The credit cards that we would recommend that you apply for and use would be prepaid credit cards. These credit cards are essentially reloadable debit cards that can positively affect your credit score. Because these cards are prepaid, there’s no fear of spending more money than what you have, which is a very real concern with standard credit cards.

Standard credit cards make it quick and incredibly easy to spend money — usually money that you do not have. This is a very common pitfall that leads to many getting deep in debt. If you absolutely insist on obtaining and using a standard credit card, we strongly urge you to read about all of the associated fees, possible hidden charges and to find a card that does not have an outrageously high interest rate. You should only use that credit card in absolute emergencies or when you have the cash to fully pay for any purchases you make on it and save that money so you will be able to pay it off as soon as the bill is due.

Paying the minimum required amount on a credit card is the same as paying the minimum amount on a standard loan that we talked about earlier in this guide. You will be paying mostly interest with each payment, and you will barely be making a dent in the actual principal amount owed.

If you have to take out a loan for whatever reason, there’s a few loan agreement clauses that you should absolutely avoid at all costs. These are:

- Unreasonably high-interest rates;

- The inclusion of an Early Repayment Charge – which states that if you pay off a loan before the set deadline is up, you will be charged with a hefty fine;

- Acceleration Clauses – a clause that states if the borrower defaults for any reason, the balance of the debt will be owed in full immediately with no recourse options for the borrower to remedy the situation;

- Attorney’s Fees Clauses – which allow the lender to charge you for their attorney fees that they will incur during the process of suing you if you default on the loan for whatever reason;

- Balloon Payment Clauses – monthly payments for the term of the loan that are too small to actually pay off the loan in full, with a final payment that is generally extremely large to bring the debt balance to $0. Many unscrupulous lenders will utilize a balloon payment in an effort to entice individuals with small repayment sizes to take out a loan with them;

- Confession of Judgement Clauses – this will allow a lender to automatically take a judgement on you if you happen to default, without having to actually sue you in a court of law;

- Wage Assignment Clauses – these clauses give the lender the legal right to garnish your wages for as long as it takes to pay off the debt owed if the borrower defaults for any reason;

- Security Interests Clauses on smaller to mid-size loans – when a loan has a security interest agreement, you allowing them to legally seize your most costly assets such as a house or car, even though these assets are incredibly disproportionate in worth to the amount of the loan provided, and;

- Mandatory Arbitration Clauses – which waives your ability to take the lender to court over any disputes.

By carefully reading and taking the time to understand a loan agreement before you sign it, you can save yourself a lot of future headache if something unforeseen happens causing you to go into default on a loan. A loan agreement that includes any of these clauses is not worth the trouble they can cause, and we highly recommend you skip them and search for a more favorable loan agreement elsewhere.

Stimulating your finances can be a difficult task for anyone, but it’s something that you should adamantly and sincerely try to do. By restructuring or refinancing your current debts if possible, paying off as many financial-leaching high-interest debts as possible and by being more conscientious of where your money is going, you can revitalize your bank account with new, lush green life.

It can take many years and a lot of hard work, but getting your financial obligations under control and achieving a better income-to-debt ratio is something that is absolutely worth the effort and time. The road to having a better financial situation starts with a few simple steps towards learning how to manage your finances better.

Effectively managing your finances can prove to be a huge boon to your quality-of-life. By properly accounting for monthly expenses and budgeting accordingly, you will be able to gain a stronger financial foundation on which to build a better life.

The first thing that you should do on your path to effectively managing your finances is to ensure that you keep complete and detailed records of where all of your money is going.

This is particularly important if you pay for many things using your debit or credit card, and to a lesser extent if you pay with checks. Experimental psychological research has shown that there is a strong connection between using credit cards and debit cards and the urge to overspend. This is because we are psychologically wired in a specific way, and the way we are wired makes purchasing goods and services with credit or debit cards to be less “painful” than it is to purchase the same goods and services with cash. We are even more prone to spend more for the same items than we would if we were buying with cash.

Cash is a more tangible and real concept to us as a society than credit or debit cards are, so we are more apt to err on the frugal side when paying with cash than we are with credit or debit cards. Furthermore, this experimental research suggests that we desire to spend more money when paying with plastic because we associate the logos on these cards with consumption, so we are more inclined to keep spending even when we are not able to afford to do so.

Cash is a more tangible and real concept to us as a society than credit or debit cards are, so we are more apt to err on the frugal side when paying with cash than we are with credit or debit cards. Furthermore, this experimental research suggests that we desire to spend more money when paying with plastic because we associate the logos on these cards with consumption, so we are more inclined to keep spending even when we are not able to afford to do so.

Another problem with overspending with credit cards and debit cards is the fact that most people don’t keep detailed enough records of what they have purchased, so they are less likely to realize that they have overspent until it’s much too late. Keeping detailed records of your spending habits is generally easier when you pay in cash or with checks. Another step to effectively managing your finances is to cut out superfluous expenditures that you do not need and can not afford. Trying to obtain a certain standard of living that is above our means is something that we are conditioned by society to do, but it is extremely detrimental to our financial security.

So, to recap:

- You shouldn’t overuse your credit or debit cards to make purchases;

- You should keep highly detailed, up-to-date and clear records of where your money goes, allowing you to see exactly where the biggest flow of money is going so you can adjust your spending habits accordingly, and;

- Resist the urge to try and live above your means; make an effort to spend less money on unnecessary expenditures that serve no greater purpose.

By keeping detailed records of where you cash flow goes, you will be better equipped to cut out unnecessary expenditures and to re-balance necessary expenditures where necessary. This goes a long way in helping to prioritize your monthly expenses.Each month you should make an effort to map out what your expenses are going to be and how much money you are going to have to allot to these expenses. Monthly expenses are made up of Fixed Costs, Variable Costs and Total Costs. It is extremely important to take these into consideration when allocating your monthly funds.

By keeping detailed records of where you cash flow goes, you will be better equipped to cut out unnecessary expenditures and to re-balance necessary expenditures where necessary. This goes a long way in helping to prioritize your monthly expenses.Each month you should make an effort to map out what your expenses are going to be and how much money you are going to have to allot to these expenses. Monthly expenses are made up of Fixed Costs, Variable Costs and Total Costs. It is extremely important to take these into consideration when allocating your monthly funds.

Fixed Costs are costs that remain constant from month-to-month, examples of which are generally car payments and rent.

Variable Costs are costs that can change without notice and you should always assume these costs are going to be higher than what they actually are, allowing you to have buffer space in case the prices do increase considerably. Monthly Variable Costs would include things such as gasoline, groceries and other household essentials.

Total Costs are the combined monthly costs of Fixed Costs and Variable Costs, so what you will end up paying in total in the span of a given month. The reason it would be prudent to anticipate for higher costs when you budget your expenditures for the month is because you do not know if the prices of these items will increase and if they do not and you have spare money in your Variable Costs budget, it is highly recommended that you save back this money just in case you need spare funds quickly for things like auto repairs and other emergencies which could very easily set you back if you did not have access to these spare funds.

There are numerous online budgeting tools that you can utilize to keep your finances and expenditures under strict control. We have personally hand-picked our favorite well-rounded and free budgeting tools to help you become more in charge of your finances:

- Mint: Mint is a free, web-based personal financial tool. Mint can be used to simultaneously plug in to all of your bank accounts, investments, retirement funds, credit cards and other financial-related accounts to quickly give you a complete picture of how strong your current financial standing are. Mint also lets you set up a household budget and warns you if you’re not sticking to it, see exactly how much you’re spending on what types of purchases or utilities, set up savings goals and help you to actually stick to them.

- GnuCash: GnuCash is a free, cross-platform program that helps you to keep track of your expenditures. Gnucash uses an “always balanced” approach to managing your personal finances, meaning no transaction can be made without debiting another account for it, which makes sure the books are always straight. You can also schedule specific transactions and create recurring ones for things that happen regularly.

- LearnVest: LearnVest is free web-based personal finance program that provides you with tools for tracking your spending habits, determining your financial goals and effectively budgeting your money. It’s a great solution if you also happen to be on the hunt for a personal financial planner.

- Doxo: Doxo is an online filing cabinet for all your household and important documents, such as receipts, tax papers and check stubs. It’s also a one-stop shop for managing bill payment. The program is extremely innovative, simple, easy-to-use and highly customizable.

- WalletHub: WalletHub helps you to understand your credit report better. This web-based program is a sleek and streamlined credit score monitoring program that is completely free to use.

- Unbury.Me: Unbury.Me is an online debt management tool that is a simple and straightforward calculator tool to help you regain your financial footing. Once you enter all of your debt information, you can quickly compare which debt reduction method will work best for you and your situation and finances. Add personal tweaks to your monthly payment amount, and the chart will update to show your remaining principal balance, how much interest you’ll pay and a debt freedom date.

- The Debt Eliminator: The Debt Eliminator is an online debt management tool that was created by celebrated financial guru Suze Orman. Simply type in your name, the number of credit cards and other loans you have and how much additional money (if any) can be put toward your debts and this program will provide you with a comprehensive debt repayment plan.

Quick Tips That Will Lead to More Personal Financial Security

- Keep clear and detailed records of all of your monthly expenditures;

- Find ways to save money by cutting out unnecessary expenditures;

- Do not take out high-interest rate loans if at all possible, and be sure that you fully understand the loan agreement before you sign it, looking for any unfavorable or unfair agreement clauses that might be hidden within the agreement;

- Try and make as many purchases as possible with cash. Remember, cash is a more tangible and understandable concept than credit or debit cards are, which will help you to spend less;

- Budget your monthly Fixed Costs, Variable Costs and keep track of your monthly Total Costs. Always budget extra money for Variable Costs and save back any extra money that is left over after your financial obligations have been taken care of for the month;

- Keep an eye on your credit score;

- Set specific and realistic financial goals for yourself;

- If you’re going to get a credit card, your best option is a pre-paid credit card with a favorable user agreement;

- Cut down on the amount you eat out at restaurants or fast food places. Cooking meals at home are almost always cheaper, and you get more for what you pay;

- Prospective college students should always choose federal financial aid over private financial aid. They should also apply to every scholarship that they are eligible for;

- Always pay your bills on time, to avoid costly late fees. These can easily cut into your finances;

- Start saving money now. Not next week, not next month. Procrastination is one of the most lethal enemies to financial stability.

APR: An annual percentage rate (APR) is the annual rate that is an additional charge for borrowing and is expressed as a single percentage number that represents the actual yearly cost of funds over the term life of a loan. This rate includes any fees attached to the loan by the lender or additional costs associated with the transaction.

Asset: Anything that has a value associated with it, either tangible or intangible. Any interest in real or personal property which can be appropriated for the payment of debt.

Budgeting: The act of allocating a set amount or a percentage of income to cover the cost various expenses.

Collateral: Assets pledged to secure the repayment of a loan in the event of the loan going into default.

Concessional Loan: A concessional loan, sometimes referred to as a soft loan, is a loan that is granted on terms substantially more generous than current market loans either through below-market interest rates, by grace periods or a combination of both. Such loans may be made by foreign governments to developing countries or may be offered to employees of lending institutions as an employee benefit.

Covenant: A contractual and legally-binding agreement or promise to do or to not do a particular thing. The following are functional objectives guiding most loan covenants: full disclosure of information, preservation of net worth, maintenance of asset quality, maintenance of adequate cash flow, control of growth, control of management and assurance of legal existence.

Debt Service: Amount of payment due regularly to meet a debt agreement; the payments are usually a monthly, quarterly or annual financial obligation.

Default: A failure to pay on a loan in a timely manner or an act that breaks the terms of a loan. The word is most often used to describe the occurrence of an event that cuts short the rights or remedies of one of the parties that entered into an contractual agreement with another party. For example the failure of the mortgagor to pay a mortgage installment or to comply with mortgage covenants would be considered to be in default.

Delinquent: In a monetary context, something that has been made payable and is overdue and unpaid. When a borrower has failed to make a payment on the agreed upon deadline.

Demand Loan: Demand loans are short term loans that are atypical in comparison to other loan types in that they do not have fixed dates for repayment and carry a floating interest rate which varies according to the prime lending rate. They can be “called” for repayment by the lending institution at any time. Demand loans may be unsecured or secured.

Due Diligence: Refers to the task of carefully confirming all critical facts presented by a borrower. This includes verifying sources of income, accuracy of financial statements, value of assets that will serve as collateral, the tax status of the borrower and any other material facts presented by the borrower to a lending entity.

Equity: The total amount of net worth of an individual or entity after the subtraction of debt.

Fixed Costs: Are costs which remain consistent over a period of time and can be easily accounted and budgeted for. Car payments and rent are generally types of fixed costs.

Guaranteed Loan: A pledge to cover the payment of debt or to perform some obligation if the person liable for the debt fails to perform the agreed upon terms of the loan. When a third party guarantees a loan, it promises to pay in the event of a default by the borrower.

Interim Financing: A short-term loan that is used to provide temporary financing until a more permanent financing option is available.

Line of Credit: Agreement by a bank that a company or an individual may borrow, at any time, up to an established monetary limit.

Loan Agreement: A written contract between a lender and a borrower that sets out the rights and obligations of each party regarding a specified loan. This includes all loan terms.

Predatory Lending: Predatory lending is the unfair, deceptive or fraudulent practices of some lenders during the loan origination process. While there are currently no straightforward legal definitions in the United States for predatory lending, an audit report on predatory lending from the office of inspector general of the FDIC broadly defines predatory lending as “imposing unfair and abusive loan terms on borrowers.” Many people view Payday lenders, Title Pawn Lenders, certain types of credit cards and other generally high-interest rate lenders to be predatory lenders.

Promissory Note: A contractual promise to pay a set amount of money on a loan at designated times. This is a written contract between a borrower and a lender that is signed by the borrower and provides evidence of the borrower’s indebtedness to the lender.

Restructured Loan: A revision of a financial agreement that alters the conditions or covenants of the original agreement. For example, parties may agree to restructure a loan agreement, easing the payment schedule, when a borrower is delinquent or otherwise faces default on a loan. This can also be potentially utilized to lower the payments on a loan if the loan’s principal has been paid down a significant amount by the borrower.

Secured Loan: A secured loan is a loan in which the borrower pledges some asset that holds monetary value, such as a car or property, as collateral against the loan.

Subsidized Loan: A subsidized loan is a loan on which the interest is reduced by an explicit or hidden subsidy. In the context of college loans in the United States, a subsidized loan refers to a loan on which no interest is accrued while a student remains enrolled in education, and the student is not required to make any payments until an agreed upon time after graduation.

Term: Refers to the maturity or length of time until the final repayment on a loan, bond, sale or other contractual obligation has been paid by the borrower.

Total Costs: Total costs are the sum of variable costs and fixed costs that an individual will have to pay out per week, month or year. When a person’s total costs exceed their income, they will generally incur debt.

Unsecured Loan: Unsecured loans are monetary loans that are not secured against the borrower’s personal assets. These may be available from financial institutions under many different guises or marketing packages, such as: credit cards, personal loans and peer-to-peer lending.

Variable Costs: Costs that can change with or without notice in a short amount of time. The price of gas or groceries are variable costs.

Learning how to properly manage your finances and how to get your debt under control can be a rough and long road, but it is one that you do not have to travel alone. Reach out to online communities, your friends, your loved ones, college professors, colleagues. Talk to anyone who may be able to help you navigate the treacherous path to financial freedom, whether it’s through sound advice that can be backed up with proof or it’s just an ear being lent to you for you to vent your frustrations.

Learning how to properly manage your finances and how to get your debt under control can be a rough and long road, but it is one that you do not have to travel alone. Reach out to online communities, your friends, your loved ones, college professors, colleagues. Talk to anyone who may be able to help you navigate the treacherous path to financial freedom, whether it’s through sound advice that can be backed up with proof or it’s just an ear being lent to you for you to vent your frustrations.Always keep reminding yourself that all you have to do is set realistic financial goals and to be more fiscally mindful with your income and expenditures and you will be able to conquer the monsters that strike fear into the hearts of most adults; debt and financial instability. We hope you found this guide helpful, and we wish you all the luck in the world!

Financial Resources:

- FAFSA

- U.S. Department of Education’s Guide to Repaying Federal Student Loans

- U.S. Department of Education’s Guide to Understanding Federal Student Loan Repayment Options

- U.S. Department of Education’s Guide to Federal Student Loan Forgiveness

- The Federal Trade Commission’s Guide to Coping with Debt

- The Federal Trade Commission’s Guide to Wise Shopping Methods and Saving Money